Our Investment in Nina

We’re excited to share our investment in Nina Protocol. We have been thinking a lot about how web 3.0 can benefit musicians and fans, and how it changes the distribution and ownership models musicians can experiment with. To accomplish this revolution, an open and permissionless foundation is crucial. An open protocol layer allows applications to build on top without guardrails or platform risk - this is an essential building block for revolutionizing music. Nina is that building block.

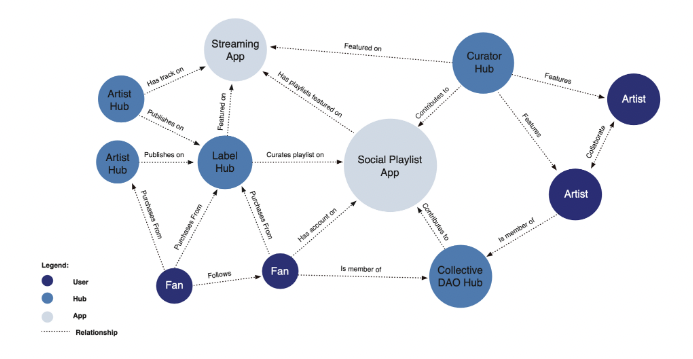

Nina provides musicians with the tools to publish, monetize, and distribute their music without middlemen. Nina is a protocol, not a platform. By remaining neutral, Nina empowers artists to establish their own context around their music, something that has been sorely missing with streaming platforms. As a protocol, Nina also encourages third-party applications to build atop, whether that be a streaming service, content curator, or another service we’ve not yet discovered. Spinamp, and Future Tape are two streaming applications that already leverage Nina’s open data to make music easy to listen to.

Nina empowers artists to:

-

Publish their music to Arweave, leveraging the permanent storage network that their art lives on.

-

Monetize their work using Solana to detail the release price, the number of copies, royalty splits, secondary market fees, distribution incentives, etc.

-

Distribute through their hosted marketplace or through third-party applications. Through the release of Hubs, Nina has built a social graph that tracks relationships between curators, collaborators, and releases.

Hubs are a unique and powerful tool for tracking relationships between releases, collaborators, and curators. Hub owners can set publishing and affiliate fees to receive a split anytime a release is published or purchased through the Hub. NFTs unbundle the music industry and Hubs incentivize third parties to curate and aggregate music for fans. In doing so, these emergent curation services can receive a direct share of artist revenue.

Source: Nina

Imagine a music blogger reviewing a new album and earning a fee anytime a reader purchases the album through their site. Imagine a fan that creates a playlist of their favorite songs, receiving a cut anytime someone buys through their link. Or imagine a DAO music label that receives a cut of sales when an artist publishes through their Hub. Hubs are one of the most exciting developments in music.

A lot has been said about how NFTs can empower artists but they also improve the demand side, the fans. Nina’s toolset improves the fan experience. Through streaming apps, music can be free to listen to and valuable to collect. Because the protocol layer is open, fans can interact with the music in a variety of ways. They can select their favorite streaming app based on the user experience and curation it provides, rather than the artist lock-in each app has. Fans can even build their own curation service leveraging Nina’s data on the backend.

We’ve been impressed by the team’s vision and their ability to focus on building a long-lasting product despite the immense short-term distractions and hype in the market. They take a music-first approach. As long-time musicians, they’re building a product to solve problems they’ve faced first-hand.

Open systems enable a sort of creative anarchy where it’s impossible to predict the resulting innovations. We saw this with the advent of the web and are seeing it again now with innovative projects like Nina Protocol. We’re thrilled to be part of the journey and we’re excited to see how Nina sparks creativity in the music community.

The information herein was prepared by Plaintext Capital Management LLC (“Plaintext”) and is believed by Plaintext to be reliable and has been obtained from public sources believed to be reliable. Plaintext makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of Plaintext and are subject to change without notice. This is not an offering or the solicitation of an offer to purchase an interest in any fund managed by Plaintext (collectively, the “Fund”). Any such offer or solicitation will only be made to qualified investors by means of a confidential private placement memorandum and only in those jurisdictions where permitted by law. The identified investment does not represent or approximate all of the investments purchased, sold, or recommended for the Fund. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the identified investment. An investment in the Fund is speculative and involves a high degree of risk. Opportunities for withdrawal, redemption, and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. No assurance can be given that the investment objective will be achieved or that an investor will receive a return of all or part of his or her investment. Investment results may vary substantially over any given time period.